22+ montana paycheck calculator

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Enter your info to see your take home pay.

. The Montana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Montana State. Number of atoms calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income. It is not a substitute for the advice of. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Montana residents only.

Your average tax rate is 1198 and your marginal tax rate is. Back to Payroll Calculator Menu 2013 Montana Paycheck Calculator - Montana Payroll Calculators - Use as often as you need its free. Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Montana. Need help calculating paychecks. This free easy to use payroll calculator will calculate your take home pay.

Just enter the wages tax withholdings and other information required. Supports hourly salary income and multiple pay frequencies. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Montana Hourly Paycheck and Payroll Calculator. Ti34 multi view calculator. Payroll pay salary pay check.

This Montana hourly paycheck. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The state tax year is also 12 months but it differs from state to state.

Some states follow the federal tax year some. As an employer in Montana you have to pay unemployment compensation to the state. If you make 70000 a year living in the region of Montana USA you will be taxed 12710.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Montana Income Tax Calculator 2021. The 2022 rates range from 1 to 675 on the first 35300 in wages paid to each.

Uv Reading Glasses Blue Light Glasses Computer Reading Glasses Eye Strain Clear Anti Uv Filter Protection Men Women Uv Blocking Glasses Amazon Co Uk Health Personal Care

Paycheck Calculator Take Home Pay Calculator

Montana Paycheck Calculator Smartasset

822 River Gorge Rd Superior Mt 59872 Realtor Com

Montana Wage Calculator Minimum Wage Org

California Food Stamps Eligibility Guide Food Stamps Ebt

Entrepreneurs On Fire Podcast Boomplay

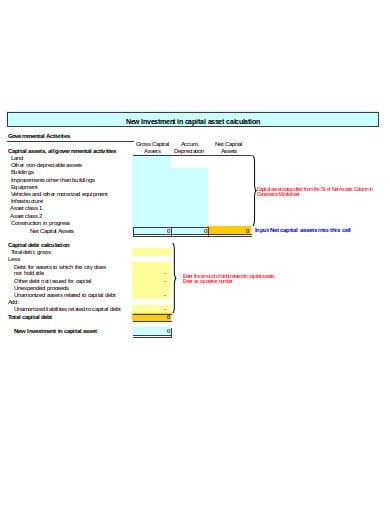

11 Investment Templates In Excel Free Premium Templates

Free Payroll Tax Paycheck Calculator Youtube

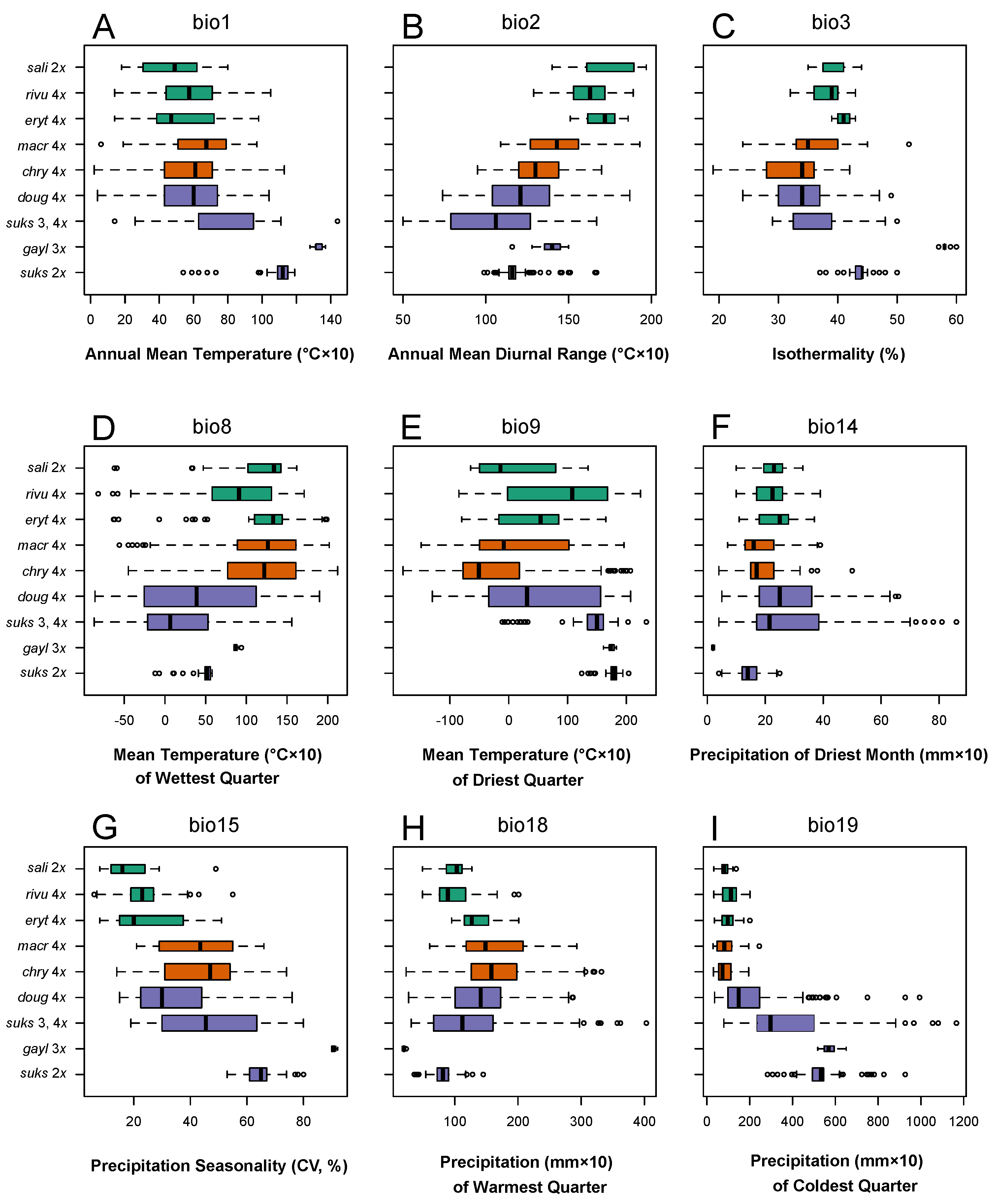

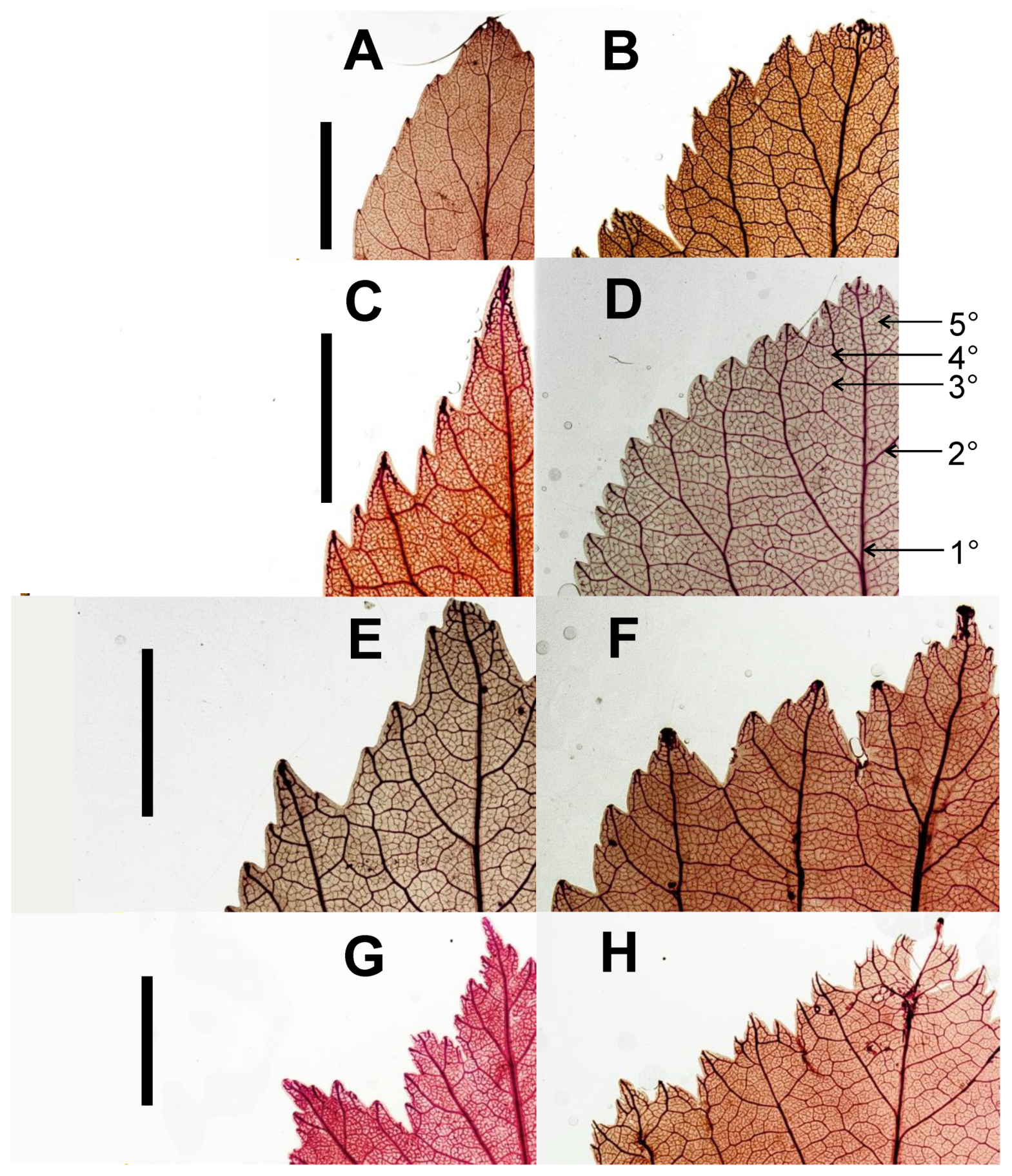

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

Pdf Machine Learning On Human Connectome Data From Mri

3 12 154 Unemployment Tax Returns Internal Revenue Service

Allometric Relations In Tropical Agroforestry Content

Montana Salary Calculator 2022 Icalculator

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Paycheck Calculator Hourly Salary Usa Dremployee